The FinTech industry is undergoing ongoing transformation powered by user experience (UX). Traditional banking’s continuing transformation reveals that modern software solutions require effective customer experiences to succeed. Modern customer experiences focus on both product functionality and user-friendly interaction.

The FinTech industry relies on user experience (UX) as its foundational component to transform financial service creation and user interface delivery. UX has become essential for customer satisfaction because it provides the cornerstone against which companies compete for loyal customers in a sector known for outdated interfaces and complex processes. The FinTech market’s projected $698.48 billion revenue by 2030 creates rapid growth that drives intense competition among companies to develop innovative yet user-focused solutions. Competitive market pressures force companies to build tools that exceed functional standards by delivering efficient usability and user engagement.

Boost Engagement Through Tailored UX/UI Design

Designing Impactful Digital Experiences That Foster Connection and Increase Sales

Discover UI/UX DesignThis article explores the benefits of using UX in FinTech and helps you choose the best strategy for your business.

Why UX Matters in FinTech?

The intrinsic complexity of FinTech sector processes includes investments, lending, payments, and insurance services. Throughout history, these services have proved challenging to understand because they adopted complex procedures that used technical terminology. The modern FinTech movement focuses its core values on user experience by simplifying complex financial systems.

PwC’s industry research demonstrates that 88% of financial customers demand innovative digital money tools that perform better than classic banking methods. FinTech companies seeking more market share should focus on delivering smooth, accessible, and engaging user experiences, as the market is expected to grow to $698.48 billion by 2030.

AI-Powered Personalization

The fintech industry is transforming through artificial intelligence (AI) and machine learning (ML) technologies, which produce highly personalized user interactions. By examining vast amounts of data, these technologies can understand how users act, prefer, and need things so FinTech companies can develop customized solutions that improve satisfaction and engagement.

Predictive Analytics for Tailored Financial Advice

Predictive analytics systems powered by artificial intelligence deliver individualized financial guidance when they analyze how users spend their money and what their investment targets and risk levels represent. AI algorithms examine past financial data and today’s market patterns to find optimal investment methods and profitable saving and budgeting measures, enabling users to make better financial choices.

AI-Driven Chatbots for Customer Support

The FinTech industry is revolutionizing customer support thanks to AI-powered chatbots. This virtual assistant software utilizes natural intelligence to efficiently handle multiple customer service requests by delivering instant, precise answers. By combining natural language processing (NLP) with machine learning technology, chatbots provide conversational interactions that enhance users’ experience.

Personalized Dashboards and Insights

Through AI-powered dashboards, users receive real-time information about their current financial status. These dashboards provide effortless tracking of financial goals by displaying personalized insights into spending habits, investment performance, and savings progress. A user-friendly presentation of financial data through tailored dashboards empowers individuals to manage their financial affairs effectively.

Gamification for Financial Engagement

The innovation of gamification functions enables FinTech businesses to improve financial management by creating an engaging user experience. Financial applications that adopt gaming elements drive users toward good financial conduct throughout their efforts to reach their money objectives.

Points and Rewards Systems

Businesses deploy the points and rewards system as a fundamental gamification feature. Users gain points after performing financial-related tasks, such as making deposits, making on-time bill payments, and reaching their savings targets. These points function as currency to redeem rewards such as discounts, cashback, and exclusive offers, which help maintain user engagement with the app.

Challenges and Achievements

The combination of financial accomplishments, achievements, and challenges creates an exciting competitive aspect of financial management. Users compete in financial challenges by aiming to save specific amounts over defined durations while controlling unnecessary costs. Completing challenges generates user badges, which build a feeling of success while driving them to sustain their responsible money choices.

Progress Tracking and Leaderboards

Users can monitor their financial progress by tracking it through leaderboards that enable them to compare their performance to others. Visual progress bars, along with charts and leaderboards, allow users to see their achievements while clearly inspiring better financial behavior. These interactive elements create a community atmosphere that enhances user participation and fosters sustained financial outcomes.

Data Visualization and Intuitive Interfaces

Advanced visualization techniques within FinTech help users interact with financial information through innovative data presentation methods. By transforming complicated data into simple interactive visual elements, FinTech companies improve user comprehension and accessibility to financial management.

Advanced-Data Visualization Techniques

When applied to financial data presentation in FinTech, operators use advanced visualization tools to create easy-to-understand graphical displays. Financial technology companies are adopting interactive visualizations that combine graphs and charts with customizable dashboards and budget-tracking displays.

Interactive Charts and Graphs

These tools allow users to explore their data dynamically. When they hover over data points, they gain access to detailed information. They can also explore specific time frames and contrast multiple datasets. Through interactive capabilities, users can extract more detailed financial data insights, which support better decision-making.

Customizable Dashboards

Users can modify existing dashboards through selectable display options to personalize their financial data presentation. They can choose which financial metrics to show on their dashboards, sort dashboard components for optimal viewing, and establish alerts for particular financial milestones. Through personalized features, users can experience instant access to their most important financial data.

Visual Budget Trackers

Visual budget trackers display financial information through graphs to help users track spending and savings activities. Features that combine progress bars with pie charts alongside color-coded categories make it easy for users to view their financial health status. Visual budget trackers simplify financial data for users through visual elements, helping them maintain their budgets and reach their financial targets.

Importance of Simplifying Complex Financial Information

A vital requirement for improving the user experience of FinTech applications is making difficult financial information easier to understand. Financial data can be extremely difficult to handle for users who lack financial expertise. Through straightforward data display, FinTech companies extend financial accessibility to users from diverse backgrounds.

Data visualization techniques enable users to understand important information quickly while lowering mental strain, making decisions simpler. This design approach leads to better user satisfaction, increased user interaction, and sustained user loyalty.

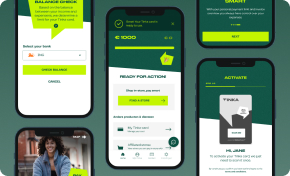

Seamless Onboarding and User Education

To succeed with FinTech applications, users need a well-designed onboarding process and effective educational methods. These elements help users rapidly comprehend and use the application features, improving adoption rates and sustaining user engagement.

Importance of Smooth Onboarding Process

FinTech apps drive user engagement through their onboarding process, directly influencing users’ experiences on the platform. Users who encounter a smooth onboarding process exhibit higher satisfaction levels and are more likely to continue using the system. Key elements of an effective onboarding process include:

- Fast Sign-up: Shorter and simpler sign-up procedures, combined with minimal data requirements, enable users to complete registrations without obstacles.

- Clear Guidance: When clear directions are paired with visual indicators, users have greater confidence in navigating the app. They also receive support through step-by-step instructions, progress indicators, and welcoming onscreen messages.

- Immediate Value: Users are likelier to remain engaged with an app that demonstrates its benefits and key features at the outset of their experience.

Innovative Approaches to Financial Education

FinTech apps with modern financial education methods allow users to make smart financial choices. These approaches include interactive tutorials, in-app explainer videos, contextual help, and tooltips.

Interactive Tutorials

Users find step-by-step guidance through the application features using the interactive tutorial system. The educational materials use clickable components and animated demonstrations while providing immediate feedback to improve learner understanding. When users interact with tutorial content, they enhance their knowledge of the material and better remember it.

In-App Explainer Videos

Users receive visual and audio instruction through in-app explainer videos demonstrating challenging financial concepts alongside app features. These embedded videos can be found within the app, providing users immediate access to helpful instructions. An explainer video is a powerful tool to transform complex information into easily understandable, bite-sized learning segments.

Contextual Help and Tooltips

Contextual help with tooltips delivers real-time support by showing relevant information that matches users’ active actions. Users who hover their mouse cursor over specific features within the application interface will receive contextual explanations through tooltips. This approach allows users to gain immediate assistance for their tasks without requiring them to stop working.

Biometric Authentication and Security

The FinTech industry continues to advance due to biometric technologies, which strengthen security measures and improve user interfaces. Biometric authentication is a superior method of identity verification that uses distinct biological traits to replace traditional authentication methods such as passwords and PINs.

Facial Recognition

Facial recognition technology relies on sophisticated algorithms that study and authenticate facial characteristics. This authentication method provides unmatched security since it uses hard-to-duplicate individual traits. FinTech users rely on facial recognition technology to authenticate mobile banking applications through face scans and validate financial deals. Apple’s Face ID enables users to access their devices and verify payments through facial recognition without any physical effort beyond a look.

Fingerprint Scanning

Fingerprint scanning is one of the most prevalent biometric solutions that FinTech currently employs. The process requires fingerprint pattern acquisition followed by pattern analysis for user identification. Security measures, fast operation, and user convenience characterize this approach. The authentication systems of PayPal and Mastercard, among other payment platforms, depend on fingerprint scanning technology for user verification and transaction authorization. Users find this technology beneficial because it is accessible and dependable, making it a top security option.

Voice Authentication

Voice authentication systems identify users by examining their voice-specific features, differentiating one person from another. This technology is particularly effective for customer support and transaction verification operations. It is an interactive feature of call centers and mobile applications, enabling users to manage their accounts and execute transactions through voice-based commands. This technology provides users with a hands-free authentication process, combining enhanced security and improved user experience.

Voice and Conversational Interfaces

Users now interact with FinTech applications through voice command, while conversational UI interfaces transform their financial service experiences. Natural language processing (NLP) and artificial intelligence (AI) power these technologies to develop user-friendly interfaces that enhance accessibility.

Custom Software Development for a Competitive Edge

Build Unique Software Solutions with Our Expertise

Explore Custom SoftwarePotential of Voice-Activated Financial Services

Voice-activated facilities allow users to access financial services and banking operations with voice commands. The system streamlines intricate procedures, resulting in greater user convenience when managing finances. People can perform bank account balance inquiries, fund transfers, and bill payments through voice commands to their smartphones and smart speakers. The user population that faces difficulties with traditional digital interfaces finds voice-activated services especially useful.

Rise of Conversational UI in FinTech Apps

FinTech apps embrace Conversational UI, which operates through AI-driven chatbots and virtual assistants, contributing to their growing popularity. Users can receive immediate assistance and customized financial guidance through these interfaces while accessing intuitive financial services. Through user interaction, they can query their accounts, review transaction details, and obtain investment guidance from chatbots. With their conversational design, FinTech apps achieve better user engagement and provide superior service quality to their customers.

Accessibility and Inclusive Design

The FinTech industry needs to develop accessible and inclusive design systems. All users, regardless of physical abilities, must have usable financial service access. Inclusive design improves both the customer experience and the range of users who benefit from products.

Importance of Designing for All Users

FinTech accessibility involves developing solutions for disabled users whose conditions include visual and auditory measures and affect motor functions and cognitive processes. FinTech companies support accessibility through design choices that enable all users to use their products even if traditional interfaces limit their capabilities. As an integral part of social inclusion, this method meets both regulatory standards and ethical obligations.

Features that Enhance Accessibility in FinTech Apps

Several features can enhance accessibility in FinTech apps:

- Screen Readers and Voice Commands: Users with visual impairments can operate the app using screen readers combined with voice command features to perform functions without viewing graphical elements.

- Adjustable Text Size and Contrast: Adjustable text size combined with contrast options provide users with enhanced visual accessibility for those with visual impairments.

- Keyboard Navigation: Keyboard navigation accessibility enables app use for users with motor impairments because they struggle with touchscreen interaction.

- Clear and Simple Design: The app interface’s straightforward design accompanies easy-to-follow navigation, benefiting users with cognitive limitations.

Gain more insights reading FinTech Businesses Need a Custom Mobile App to Grow.

Cross-Platform Consistency

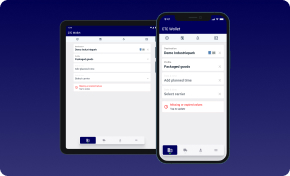

Across the FinTech industry, delivering consistent user experiences on multiple devices remains vital to ensuring user satisfaction and engagement. Financial service users rely on diverse platforms, including smartphones, tablets, and desktops, to access their services, which requires a seamless experience.

Importance of Providing a Consistent Experience Across Devices

When users experience identical applications across their devices, they develop trust in the overall system reliability. They expect to access the same design features and operational capabilities no matter what device they work with. Consistency between interfaces provides enhanced usability and stronger brand identity development. When users initiate smartphone transactions, they must finish them on their desktops without confusion or interruptions1. Platform navigation becomes frictionless, and user loyalty grows whenever platforms maintain consistent functionality and design principles.

Experience the Power of Mobile Application Development

Transformative Mobile Solutions for Your Business Growth

Explore Mobile App DevelopmentChallenges and Solutions for Maintaining UX Continuity

Preserving UX continuity between devices faces obstacles because of platform differences, dissimilar screen dimensions, and dynamic user interactions. However, there are effective solutions to address these challenges:

- Responsive Design: User interfaces that utilize responsive design automatically adjust to screen sizes and layouts. This approach allows a single codebase to create matches between interface groups across different devices.

- Design Systems: A design system featuring reusable components and guidelines helps users maintain visual consistency and functional design standards. It is a standardized approach that unifies product development processes through elements that adhere to brand guidelines.

- Cross-Platform Testing: Identifying and correcting system inconsistencies requires regular testing across multiple operating systems. Consistency in user experience relies on automated testing tools that manage the testing process to streamline operations.

Blockchain and Cryptocurrency Integration

Blockchain technology is transforming the fintech industry, improving security, transparency, and operational efficiency. Integrating blockchain technology with FinTech UX creates improved trust and automates processes between different systems.

Integration of Blockchain Technology into FinTech UX

Blockchain technology establishes an immutable distributed ledger that enhances financial transaction security and transparency. Multiple FinTech solutions integrate this technology to deliver enhanced security and more efficient operations. Blockchain security methods allow users to verify identities through secured systems while protecting themselves against unauthorized access and fraudulent activity.

User-Friendly Approaches to Cryptocurrency Management

Managing cryptocurrencies can be complex, but user-friendly approaches are making it more accessible:

- Intuitive Interfaces: Simple visual interfaces enable users to handle their cryptocurrency financial assets effortlessly.

- User experiences: Users can benefit from drag-and-drop functionality, clear visualizations, and straightforward navigation features.

- Multi-Currency Support: User portfolios gain from a single platform that supports multiple cryptocurrencies, allowing them to manage their diverse assets directly from one application.

- Educational Resources: A platform that offers academic content through tutorials and guides enables users to learn more effective methods for managing cryptocurrency.

Emotional Design in FinTech

FinTech applications depend heavily on emotional design to develop trusting relationships with users and encourage engagement. Emotional design strengthens user connections and builds lasting, meaningful bonds.

Role of Emotional Design in Building Trust and Engagement

Emotional design requires interface development to produce environments that generate trust, feelings of confidence, and satisfaction with user expectations. FinTech applications utilize emotional design to reduce user financial management stress and establish financial security. The app achieves user comfort and confidence through friendly words, clear visual guides, and custom interactions.

Examples of How FinTech Apps Use Color, Typography, and Micro-Interactions

- Color: When colors are used, users often experience specific emotional reactions that influence the overall tone of the user experience. Blue typically evokes feelings of reliability and trustworthiness, while green symbolizes growth and prosperity.

- Typography: A highly readable typeface enhances accessibility, making content easier to understand. Well-designed and consistent typefaces and sizes within user interfaces yield professional results that promote uniformity.

- Micro-Interactions: Small interactive elements, such as animations, combined with instant feedback messages to user input, enhance the user experience. The app’s interactive features serve as mini experiences, fostering more responsive and engaging usability.

The Future of FinTech UX

The development of financial technology user experience in the future will depend on four significant trends: artificial intelligence-powered personalization, gamification, biometric authentication, and emotional design principles. Technological advancements have revolutionized modern financial services interactions, delivering greater access and security while increasing user engagement.

Potential Impact of These Innovations on the Financial Industry

The convergence of superior technologies and design features focusing on user needs will radically transform the financial sector. These innovations will create more secure financial services while delivering personalized user experiences to boost usage rates and customer retention levels. Implementing blockchain technology and AI will allow companies to optimize operational efficiency while lowering costs and streamlining their processes.

Ongoing Importance of User-Centered Design in FinTech

The continuing development of FinTech requires a user-centered design to maintain its central position. FinTech applications remain effective and relevant when users’ needs and preferences become organizational priorities. FinTech companies differentiate themselves in the market through outstanding user experiences, which helps them establish lasting customer bonds.

FinTech UX demonstrates an optimistic future trajectory, offering multiple possibilities for developing innovations and growth potential. Schedule a meeting with us to help you identify the proper solution for your business growth strategy.

Streamlining Your Path to Effective Product Discovery

Make Your Ideas a Reality in Four Weeks with Our Results-Driven TechBoost Program

See Product Discovery ServicesGain more insights on FinTech Software development by reading Integration Strategies for Your FinTech Mobile App.