The financial industry, a frontrunner in the digital revolution, has seen a notable surge in finance app usage and revenue. In 2023, the global finance app market generated an impressive $1.55 billion, a 19% increase from the previous year. This growth is reflected in user behavior; finance app installs soared by 50%, with banking apps experiencing a 55% increase. This trend highlights a shift towards mobile financial transactions and an enhanced user experience.

Would you miss out on increased user engagement and increased revenue because a mobile app seems to be complex? User engagement with finance apps also saw a significant rise in 2023. The first half of the year recorded a 17% increase in app sessions compared to 2022, with banking and payment apps leading this uptick. This increased engagement indicates the growing reliance on digital financial services.

Customized Mobile Apps to Elevate Your Business

Building Mobile Apps that Bridge Your Business with Your Audience

Explore Mobile App DevelopmentAccording to a G2 report, 75% of global consumers have used a fintech service for online or mobile app payments, illustrating fintech’s deep integration into everyday financial activities. The fintech market is evolving rapidly, encompassing digital payments, investments, capital raising, digital assets, and neobanking. Notably, neobanks have disrupted traditional banking by offering innovative, customer-centric solutions that appeal to today’s digital-savvy consumers. The rise of digital assets and neobanking is poised to continue reshaping the financial landscape.

To stay ahead of the curve, businesses must integrate robust fintech solutions into their mobile apps to stay competitive. This integration is crucial for remaining relevant and delivering value to the modern, tech-savvy consumer.

What’s Holding FinTech Companies Back from Mobile Adoption

Venturing into customer-facing mobile applications presents a daunting challenge for many FinTech companies. While the prospects are enticing, certain apprehensions and misunderstandings often hold them back from embracing this digital stride.

Navigating the Complexity of Mobile Apps

A primary concern is the lack of a comprehensive understanding of how mobile apps function. This includes worries about development, maintenance, device compatibility, and providing a smooth user experience. Such fears can stem from limited experience with mobile technologies, leading to hesitation in adopting them.

Invest in Professional UX/UI Design to Create Impactful Interfaces

Designing Seamless User Journeys That Boost Interaction and Conversion Rates

Discover UI/UX DesignMisjudging Integration Efforts

The perceived complexity of integrating the mobile app with the financial backend is another major hurdle. Companies often overestimate the resources and efforts needed for this integration, seeing it as an expensive and time-consuming process. However, with the right approach, this integration can be more manageable than expected.

Defining App Features and User Experience

Deciding on the app’s specific features can also be challenging. FinTech companies struggle to balance between offering comprehensive services and maintaining an intuitive interface. Determining the key banking functionalities and their presentation, while ensuring security, adds to the complexity.

Addressing Security Concerns and Market Dynamics

Security concerns are critical, given the sensitivity of financial data. The fear of data breaches and compliance issues is a significant deterrent. Additionally, keeping up with changing market trends and customer expectations requires not just technical expertise but also market insight, further complicating the move to mobile.

For FinTech companies, overcoming these fears involves demystifying mobile app development, understanding integration and security protocols, and staying updated with market trends. Addressing these concerns is key to confidently stepping into the mobile domain and providing efficient mobile financial services.

Strategies for Successful Mobile App Integration in FinTech

As FinTech companies navigate the complexities of mobile app adoption, it’s crucial to establish effective strategies for seamless integration. This section outlines key steps and best practices for integrating mobile applications into the FinTech landscape, ensuring a smooth and efficient transition.

Developing a Clear Mobile App Roadmap

A well-defined roadmap is essential. This involves understanding target user needs, setting realistic goals, and planning for long-term app scalability. A clear roadmap helps align the app’s development with business objectives and user expectations.

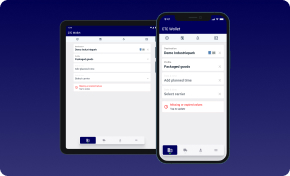

Leveraging Agnostic Microservices for Flexible Integration

The use of agnostic microservices can play a pivotal role in simplifying app integration. Microservices offer a modular approach, enabling the development of independent components that can be easily integrated and scaled. This approach fosters flexibility and agility in app development, allowing FinTech companies to adapt to changing needs and technologies without overhauling their entire system.

Prioritizing User Experience and Interface Design

A user-centric design is paramount for the success of a FinTech app. This section emphasizes creating intuitive and engaging interfaces that simplify user interaction, enhancing overall user satisfaction and engagement with the app.

Ensuring Robust Security and Compliance

Implementing stringent security protocols and ensuring compliance with financial regulations are critical. HyperSense Software’s articles on strong authentication in FinTech and mobile apps’ strong authentication provide valuable insights into building robust security frameworks. These strategies not only protect sensitive financial data but also build customer trust and loyalty by adhering to the highest standards of security and regulatory compliance.

Experience Expert IT Consultancy

Transformative Strategies for Your Technology Needs

Discover IT ConsultingLeveraging Data Analytics for Continuous Improvement

Finally, the use of data analytics is crucial in tracking app performance, user behavior, and feedback. This data is invaluable for continually refining the app, ensuring it meets user needs and stays ahead in the competitive market.

By following these strategies, FinTech companies can effectively address their initial apprehensions, integrate mobile technology into their services, and thrive in the dynamic digital finance arena.

Planning Your FinTech Integration Strategy

Crafting a successful FinTech integration strategy for your mobile app is a critical step that requires careful planning and foresight. This concise guide offers a roadmap to navigate this process effectively.

Identifying Business and Customer Needs

Begin by thoroughly understanding both your business objectives and your customers’ needs. This dual focus ensures that your app not only aligns with your company’s goals but also resonates with your target audience. Consider factors like user demographics, preferred functionalities, and how your app can solve specific financial challenges faced by your users.

Selecting the Right Technology and Partners

Choosing the appropriate technology and partners is pivotal. Opt for technology solutions that offer scalability, security, and user-friendly interfaces. Additionally, partnering with experienced FinTech service providers can bring invaluable expertise and insights to your project, ensuring a more robust and efficient integration.

Setting Realistic Timelines and Budgets

Finally, establish realistic timelines and budgets. FinTech app development can be complex, and it’s crucial to allocate sufficient time and resources to each stage of the project. Proper planning in these areas helps in avoiding overextension and ensures a smoother development process.

Best Practices for Effortless FinTech Integration

For FinTech companies looking to integrate their services seamlessly, the following best practices are essential:

- Dual Technology Integration Strategy: Develop a dual approach that includes both traditional IT consolidation for non-differentiating components and a specific strategy for the fintech platform or product integration. This approach should optimize existing infrastructure while fostering growth and scalability in fintech integration.

- Enhancing Customer Benefits: Focus on customer-centric features such as easy access to services, increased security measures, greater flexibility in financial management, and faster transaction processing. These features not only improve customer experience but also build trust and loyalty.

- Addressing Regulatory and Cybersecurity Challenges: Navigate the regulatory frameworks while implementing advanced cybersecurity measures. Encryption techniques, multi-factor authentication, and regular security audits are crucial to safeguard customer information and ensure compliance with data protection regulations.

- Event-Driven Microservices Architecture: Implement an event-driven microservices architecture for efficient and scalable event exchanges. This architecture helps in building a flexible and modular system where microservices can act as both event consumers and producers.

- Event Sourcing for an Eternal Source of Truth: Utilize event sourcing to create a natural audit log for all events in the system, providing rich contextual information. This method ensures a complete history of your system’s events, aiding in troubleshooting and system analysis.

- CQRS and Materialized Views for Queries: Implement Command Query Responsibility Segregation (CQRS) and materialized views to separate write paths (commands) from read paths (queries). This separation allows microservices to use read-optimized data stores for queries, enhancing system efficiency.

- Building a Skilled Team: Consider forming a dedicated software development team with a reputable Fintech development provider like HyperSense. Selecting the right one depends on your project’s needs and long-term goals.

- Minimum Viable Product (MVP) Development: Start with an MVP to test your fintech app’s core functionality. This approach helps in gathering early feedback and focusing on the features that customers want.

- APIs and Third-Party Integrations: Ensure your app supports third-party APIs for basic transactions, budgeting, bill tracking, and other functionalities. Seamless and secure integration with other services enhances user experience.

- Ongoing Application Support: Post-launch support is vital. Continuous testing, beta versions, and customer feedback are important for refining and improving the app over time.

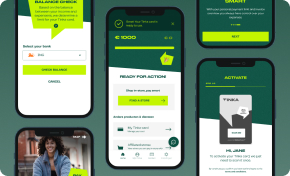

Case Study: Enhancing FinTech with Tinka Mobile App Development

The Tinka mobile app, developed by HyperSense Software, shines as a prime example of how to apply best practices and successful strategies for FinTech mobile app integration. This case study aligns seamlessly with the methodologies we’ve discussed, showcasing their practical application in a real-world setting.

Beginning of the Journey

When HyperSense Software began collaborating with Tinka, the company already had a developed financial backend and web frontend. The initial challenge was ensuring full integration and compatibility with Tinka’s existing microservice ecosystem.

Alignment with Best Practices

- Event-Driven Microservices Architecture: Tinka’s app development harnessed a modular approach, enabling the efficient scaling and integration of diverse financial services. This strategy allowed for the smooth and continuous addition of new features and services, reflecting the dynamic nature of FinTech.

- Robust Security Measures: The app employed advanced security protocols, including encryption, KYC, and strong authentication mechanisms. This comprehensive approach was key in protecting sensitive user data and ensuring adherence to stringent financial regulations.

- User-Centric Design: Emphasizing user experience, the app was crafted with an intuitive interface that facilitated easy navigation and engagement. This approach was pivotal in aligning the app with the critical priority of enhancing user experience in FinTech applications.

Tactics Use to Ease the Mobile App Development Process

- Developing a Clear Roadmap: The app’s development followed a well-structured plan, charting out the app’s evolution to align with both user needs and business objectives.

- Dedicated Mobile and Backend Development Team: A focused team approach ensured specialized attention to both mobile and backend aspects, crucial for cohesive and efficient app development.

- Leveraging Agile Methodologies: The adoption of agile development practices enabled flexibility and adaptability throughout the app’s development, facilitating the incorporation of user feedback and ongoing improvements.

Outcome and Impact

The Tinka app’s integration of multiple financial services into a singular platform provided users with a convenient and secure method to manage their finances. The focus on user experience, coupled with rigorous security measures, significantly bolstered the app’s effectiveness and appeal in the competitive FinTech space.

For a deeper dive into Tinka’s development journey, you can explore the full case study here.

Future Trends in FinTech and Mobile App Development

As we look towards the future of FinTech and mobile app development, several key trends are emerging that are set to redefine the landscape in 2024 and beyond.

Increasing Focus on Cybersecurity

With the rise of mobile banking and financial services, cybersecurity is becoming more crucial than ever. Fraud in the FinTech sector poses significant challenges, and machine learning is emerging as a promising solution to combat financial fraud. By analyzing large datasets of transactions in real time, these algorithms can identify patterns indicative of fraudulent activities, making fraud detection more efficient and reducing false positives significantly.

Rise of Mobile Payments and Gamification

There’s an expected increase in the adoption of mobile payments, driven by the growing disposable income of Millennials and Gen Z. Customer experience (CX) and open banking are becoming defining competitive differentiators in the banking sector. Additionally, the use of gamification in banking apps is gaining traction to enhance user engagement and provide tailored customer experiences.

Generative AI in FinTech

Generative AI models are being used in various FinTech solutions, including fraud prevention, asset management, and credit scoring. The capabilities of generative AI enable more informed and accurate decision-making in financial services, especially in areas like algorithmic trading, security, regulatory compliance, and personalization of financial services.

Blockchain Integration

Blockchain technology continues to grow as a vital part of FinTech products. Its transparency and security features are essential for online financial procedures, with promising applications in cross-border payments, decentralized lending and borrowing, and trade finance. Blockchain is expected to reduce costs and enhance the accessibility of banking services.

Leading Research & Development for Your Success

Driving Innovation in Every Product Aspect Through R&D-Driven Software

Learn About R&D ServicesBig Data and Analytics

Big data plays an increasingly significant role in the financial services industry. Its use enables companies to gain insights into customer behavior and preferences, improving operational efficiency and customer experiences. Big data applications in FinTech include customer segmentation, fraud detection, risk management, and cost optimization.

Voice User Interfaces (VUIs)

VUIs are set to redefine how we interact with technology, making it more intuitive and user-friendly. This technology will enable users to interact with apps through conversation, streamlining customer service interactions and enhancing the overall user experience.

Internet of Things (IoT) and Predictive Analytics

The convergence of IoT and predictive analytics is reshaping industries. In FinTech, mobile apps can provide predictive investment strategies based on real-time market data, offering insights and customized treatment plans.

On-Demand Apps

The on-demand mobile app market is expected to grow significantly, signifying the future of agility and intelligent resource management. These apps are transforming how enterprises manage operations and make critical decisions.

Accelerate Your Success with Custom Software Development

Propel Your Business Forward with Bespoke Software Solutions

Explore Custom SoftwareMicro-Interactions for Personalization

Micro-interactions are becoming key in mobile app development for personalization. These subtle features enhance user engagement and create bespoke experiences for users.

5G Technology

The advent of 5G technology is set to transform the mobile app experience with faster speeds and reduced latency. However, this also brings challenges in terms of security and privacy, necessitating robust measures to protect data.

Embracing the Future of FinTech with A Mobile App

Our exploration of FinTech and mobile app development reveals a future driven by seamless integration, robust security, and an unwavering focus on user experience. The surge in mobile finance app usage, the strategic adoption of cutting-edge technologies, and success stories like Tinka’s app development are testaments to this transformative era.

The key takeaway for businesses and developers is to remain adaptive and forward-thinking.

If you’re looking to embark on this journey or enhance your existing FinTech solutions, don’t hesitate to reach out. Contact us at HyperSense Software, where our expertise and experience are your assets in this exciting revolution.