Recently, the technology sector has seen a multitude of remarkable advancements. The miracles of technology are no longer a surprise, from AI-enabled bots aiding customer service to 3D technologies in healthcare. Technology is currently working its magic in the finance industry by creating opportunities for FinTech. In terms of providing financial services, it seeks to compete with traditional financial systems. FinTech is also offering several fresh innovations to advance monetary stability.

Cryptocurrency and blockchain are already familiar to the majority of entrepreneurs, but 2023’s FinTech trends go beyond these. Blockchain technology is replacing traditional ledgers now that the crypto markets have already fallen. Buy now – pay later and embedded financing will also result in better money circulation. Consumer financial independence will be made possible by these developments, which will also speed up business operations.

Also, consumers will be able to transition to a cashless economy thanks to innovative payment systems. Mobile wallets, in addition to debit & credit cards, are likely to become common exchange methods. Continue reading if you want to understand more about this. Here are six FinTech developments to keep an eye on in 2023.

Experience Expert IT Consultancy

Transformative Strategies for Your Technology Needs

Discover IT Consulting1. Buy Now – Pay Later 2.0

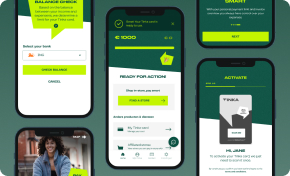

People can now divide their purchases into interest-free payments thanks to the internet environment. Buy now, pay later (BNPL) was previously exclusively available for expensive things like cars, laptops, and mobile phones. Similar to short-term loans, it allowed customers to buy things right away and pay for them later. Check out Tinka, a FinTech mobile app developed by us for the Dutch market. This year, BNPL will be linked to e-commerce fast fashion firms that cater to Gen Z & millennial consumers.

Consumers can already eat now and pay later, or commute now and pay later thanks to partnerships between a few FinTech companies and fast-food delivery apps, or with a service offered by ride-sharing apps that allow you to do the necessary trips and charge you for those at a chosen date each month. The interest-free payments alleviate default worries even though the entire project is more dependent on debt. FinTech businesses must have their plans approved by the Central Bank as BNPL grows more. The government wants to pass a law forcing lenders to consider affordability before extending BNPL. Also, certain updates to BNPL marketing are anticipated to make sure these businesses aren’t deceiving consumers.

2. Embedded Finance

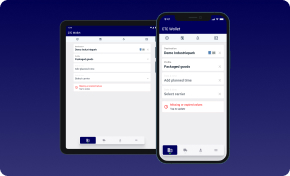

Embedded finance is here to take the lead because traditional financial approaches are no longer as popular. It incorporates all financial products and services into what non-financial institutions are able to offer. As a result, it includes insurance as well as services like banking, leasing, investing, and payment processing. Leasing is one of the kinds that is noticeably expanding.

Custom Software Perfectly Aligned with Your Strategic Objectives

Software Solutions that Fit and Enhance Your Business Strategy

Explore Custom SoftwareThe fact that all embedded finance services will be accessible via APIs is another novelty in this field. Customers will be able to create new financial services that they may incorporate into their offerings. Distribution of services is thus no longer a concern. Any digital business can provide its clients with a financial service once that friction is eliminated. These developments will increase financial inclusion because everyone will have access to financial products. Balance and Stripe are just two examples of web apps that are currently thriving in this niche of embedded finance, but there are more.

3. Payment Innovations

Innovations in fintech will transform how people pay. Using identity verification technologies, mobile wallets, and cutting-edge speaker systems, it makes contactless payments possible. Mobile wallets will emerge as a new trend in 2023 despite the surge in mobile payments that we have already seen. The Gen Z digital natives will investigate how payment innovations are being converted. They are the ones who first experienced the rise of cashless transactions, after all.

Beyond online transactions, a lot more things will be covered by mobile payments in 2023. That covers both in-person and online purchases. It will increase the value of worldwide transactions by millions while also providing customers with convenience. Overall, Gen Z will be the most significant force behind the distribution of payments. Venmo and Cash App are very popular payment innovation apps right now.

4. Alternative Financing

The global epidemic has undoubtedly had a negative impact on everyone in the world. The global finance trade deficit has grown despite banks not decreasing the capital set aside to support trade. Alternative funding will play a part in this situation. It is a theory that focuses on financing options for businesses provided by non-financial institutions. Keep in mind that none of these funds are loans.

It is more comparable to a non-loan funding alternative called revenue-based finance (RBF). Entrepreneurs can pay this back as a portion of the monthly sales of their company. The payments are therefore neither predetermined nor scheduled. Invoice factoring is another name for alternative finance. It implies that unpaid bills for a company may be sold at a loss in exchange for quick cash. Let’s go over how.

Your client may owe you $1000 for a product or a service you sold him, but he will settle the balance after a month. The non-financial institution will be glad to purchase the invoice at a reduced price if you urgently need money. Instead of giving you $1000 for the invoice, they will provide you with $900. Even though this practice isn’t new, being around for quite a while, the new eCommerce boom is what made it popular. PocketSmith is a good example of an alternative financing mobile & web app for the Australian market, that was also funded only by customer subscriptions.

5. Blockchain Technology

For cryptocurrency investors and traders, 2022 has undoubtedly been an absolute rollercoaster ride. People suffered losses when more than $2 trillion worth of coins vanished from the market. The markets will change, though, and this fall is only temporary. But, it does not imply that blockchain technology might become less important. However, blockchain has a much wider range of uses, particularly for international payments.

Blockchain will revolutionize the burdensome and expensive nature of international commercial payments. It aims to overcome these problems in international payments more quickly and securely. The costs of the transfer will be significantly reduced because there is no participation of a middleman or financial intermediary. Kaleido and Chronicled are just a few examples of blockchain technology apps that caught some attention in the US.

6. AI for FinTech

While the majority of sectors have already adopted artificial intelligence (AI), banks will soon follow the trend. By adding AI to their everyday tasks, they will probably optimize all their operations. That would result in significant cost savings and less reliance on the personnel.

Additionally, AI can analyze unstructured data, giving financial organizations the ability to uncover fresh trends and patterns. Additionally, it offers top-notch protection and can handle the rising incidence of financial fraud and cybercrimes. Overall, AI chatbots provide the best customer service. Customers can take advantage of banking help at any time, allowing for quicker transactions and better customer care. Discover more in our latest article, AI is a Game Changer For Every Industry. Kasisto, Canoe, and Enova are startups that successfully implemented AI in FinTech.

Conclusions

As 2023 started strong, we can see that FinTech will completely transform the banking industry. It attempts to encourage the usage of payment gateways, making it easier for consumers to conduct transactions and commerce. Comparable to that, it facilitates simpler account creation and payment processes, spurring global eCommerce growth. New financial inclusion technologies like embedded finance and blockchain will bring more users into the FinTech trending technology.

Experience the Power of Digital Transformation

Transformative Solutions Designed for Your Digital Growth

Explore Digital TransformationIf you’re looking to join the FinTech market with a new app specially developed for your customers, book a meeting with HyperSense, and let’s shape together the future of your business.