The FinTech landscape is unmistakably tilting towards mobile. By 2021, mobile banking became the go-to method of account access for 43.5% of U.S. consumers, eclipsing other banking channels and making it the most dominant banking method. More tellingly, the majority, a whopping 61%, turned to digital banking services at least once a week. Fast forward to 2022, a report by Insider Intelligence underscores this transition even further: a staggering 89% of respondents affirmed their use of mobile banking. And when we hone in on the younger generation, the figures are even more telling; a nearly unanimous 97% of millennials use mobile banking.

Experience the Power of Mobile Application Development

Transformative Mobile Solutions for Your Business Growth

Explore Mobile App DevelopmentIn this wave of digitization, how can financial platforms keep pace, especially when it comes to ensuring the security of their ever-mobile user base? As we delve deeper into the FinTech-mobile synergy, the importance of robust, mobile-specific strong authentication becomes clear. Join us as we journey through this evolution and explore the opportunities and challenges that lie ahead.

Why Mobile Apps are the Game-Changers for Strong Authentication

In an age where the mobile device is an extension of oneself, the potential of mobile apps in the realm of FinTech security is immense. But what exactly makes them so transformative? Let’s unpack the reasons:

- Ubiquity of Devices: With nearly every individual owning a smartphone, mobile apps provide an immediate channel to reach users. This wide accessibility ensures that security measures, once seen as high-tech luxuries, become commonplace.

- Device-Specific Features: Modern smartphones come with an array of built-in security features. From fingerprint scanners to facial recognition, these biometric tools offer a highly personalized layer of authentication, difficult to replicate or breach.

- Real-Time Interactivity: Mobile apps allow for instantaneous alerts and notifications. In case of suspicious activities, users can be notified in real-time, and immediate actions (like blocking transactions) can be triggered, offering a dynamic defense mechanism.

- User Behavior Analytics: Mobile apps can track and learn from user behaviors—like typical login times or frequently used transaction pathways. Any deviations can be flagged, providing an additional layer of behavioral-based security.

- Adaptive Authentication: Depending on the risk level of a transaction or request, mobile apps can adjust authentication requirements. For instance, transferring a large sum might necessitate multiple authentication steps, while checking an account balance remains simpler.

- Continuous Updates: In the rapidly evolving world of cybersecurity threats, staying updated is crucial. Mobile apps can push regular security updates to users, ensuring that the authentication mechanisms remain cutting-edge.

By intertwining convenience with advanced security features, mobile apps stand at the forefront of the next big leap in FinTech authentication. They don’t just offer stronger defenses—they redefine the very user experience of security, making it more intuitive and user-friendly.

Custom Software Development for a Competitive Edge

Build Unique Software Solutions with Our Expertise

Explore Custom SoftwareHow Mobile Apps Elevate Strong Authentication in FinTech

The dynamic world of FinTech demands innovation not just in services, but also in security. With their ubiquity and flexibility, mobile apps offer unmatched avenues to integrate advanced authentication techniques. Here’s how they do it:

- Integrated Biometrics: Gone are the days when passwords were the only line of defense. Mobile apps leverage smartphones’ built-in biometric capabilities—like fingerprint and facial recognition—to provide swift and secure access. The personal nature of biometric data makes it an especially robust layer against potential breaches.

- Geolocation Checks: With built-in GPS capabilities, mobile apps can determine if a transaction request comes from a familiar location or an unusual one. This geographical data can act as an added layer of security, flagging any transactions that might originate from high-risk areas or unfamiliar locations.

- Token-based Authentication: Tokenization offers a method where a user’s sensitive data is replaced with a unique symbol or “token”. This token, which lacks intrinsic value, can be sent directly to the user’s device. It’s a time-sensitive and secure way to verify authenticity, especially during financial transactions.

- Behavioral Analytics: Mobile apps have the capability to monitor and learn from how users typically interact. Swiping patterns, typing speed, and app navigation routes can all be studied. If there’s a deviation—say, a slower typing speed or an unusual transaction pattern—the app can flag it as a potential threat and act accordingly.

- Device Binding: Mobile apps can bind a specific account or service to a particular device. This means, even if someone knows your credentials, they can’t access the account from another device without going through additional verification steps.

- Secure Channels for Communication: Mobile apps can utilize end-to-end encryption for all communications, ensuring that data, whether it’s a chat with customer service or transaction details, remains confidential and tamper-proof.

Mobile apps, thus, do more than just porting traditional security mechanisms onto a smaller screen. They reimagine and enhance these mechanisms, capitalizing on the unique features of mobile devices. The result? A seamless blend of user experience and top-notch security, tailored for the demands of modern FinTech.

Overcoming the Hurdles: Best Practices and Considerations

Harnessing the benefits of mobile-based authentication in FinTech while sidestepping its pitfalls requires thoughtful planning, innovation, and foresight. Here are the guiding principles and best practices to keep in mind:

Your Path to Innovation Starts with Digital Transformation

Customized Digital Strategies for Competitive Advantage

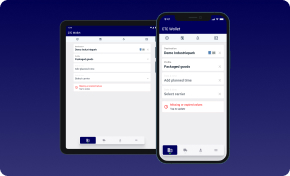

Explore Digital Transformation- Embrace Platform-Specific Development: Instead of aiming for a one-size-fits-all solution, design your mobile app to cater specifically to the nuances of different platforms (iOS, Android, etc.). This ensures a consistent user experience across diverse devices and operating systems.

- Regular Security Audits: Continually monitor and audit your mobile app for potential vulnerabilities. Utilizing penetration testing and threat modeling can help identify weak points before they’re exploited by malicious actors.

- Transparent Communication: Engage with users transparently about the data you collect and its purpose. Ensuring them of their data privacy can build trust and promote a positive user experience.

- Layered Authentication: Incorporate a layered approach to authentication. If one method is compromised, another can serve as a backup. For instance, if biometric access fails, the user could resort to a PIN or a one-time passcode.

- Educate Users: Regularly update users on best practices for mobile security. This can be done through in-app notifications, emails, or dedicated sections within the app. An informed user is a secure user.

- Optimization for Performance: Ensure that authentication processes are optimized to minimize battery and performance drains. Regularly update the app to utilize the latest in mobile tech efficiency.

- Swift Incident Response: Have a plan in place for security breaches. Quick response mechanisms can help mitigate damage and restore user trust. Ensure users can quickly and easily report any anomalies they notice.

- Leverage Cloud Security: Utilize secure and encrypted cloud services for data storage and processing. Cloud providers often offer robust security measures that can enhance the app’s defense mechanisms.

- Stay Updated: The FinTech and cybersecurity landscape is ever-evolving. Stay informed about the latest threats, trends, and innovations in the space, and adapt your strategies accordingly.

By adopting these best practices and maintaining a proactive stance, financial platforms can successfully navigate the challenges of mobile-based authentication. The result? A secure, seamless, and user-centric mobile experience that’s prepared for the future of FinTech.

Enhance User Experience with Our UX/UI Design Services

Crafting User-Centered Designs That Enhance Engagement and Maximize Conversions

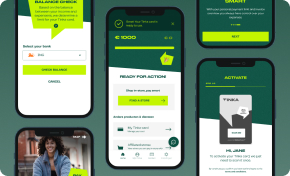

Discover UI/UX DesignReal-World Examples of Mobile-Based Authentication in Action

Mobile apps, with their inherent advantages, are swiftly becoming central to many authentication processes. Their capability extends beyond the app itself, providing value in a wide range of scenarios. Let’s delve into some of these real-world examples:

- Mobile Apps as 2FA for Other Devices: One of the most prevalent uses of mobile apps in strong authentication is in the realm of Two-Factor Authentication (2FA). When a user attempts to log in from a different device, the system’s backend can automatically send a push notification to their mobile app. This notification prompts the user to confirm or deny the login attempt, adding a dynamic and real-time layer of security that is difficult for intruders to bypass.

- Login Notifications: Consistent with the theme of real-time alerts, mobile apps can be set up to notify users every time their account is accessed from a different device. This not only keeps users informed but also acts as an early warning system in case of unauthorized access, allowing for rapid response and mitigation.

- QR Code Scanning for Web Login: Instead of manually entering credentials on a website, users can scan a QR code displayed on the screen using their mobile app. This method not only speeds up the login process but also eliminates the risks associated with keyloggers or phishing websites, as no manual data entry is required.

- Transaction Approvals: For high-value transactions, mobile apps can be used to send a detailed breakdown of the transaction to the user for approval. This ensures that even if a malicious actor gains access to an account, they can’t make significant changes or transfers without the user’s express permission via their mobile device.

- Time-based One-Time Passwords (TOTPs): Many mobile apps can generate time-sensitive codes that users can enter as a secondary authentication method. These codes are valid for only a short duration, ensuring that even if intercepted, they can’t be used maliciously after their short validity period.

By implementing these practices, the seamless integration of mobile apps into the authentication ecosystem becomes evident. Each example underscores the fact that mobile apps aren’t just passive participants in the authentication process; they’re active enforcers of security, leveraging their unique features to bolster defenses across the board.

Conclusion: The Future is Mobile-Driven Authentication

The FinTech sector, driven by rapid technological advancements and an ever-evolving threat landscape, is at a crossroads. On one hand, there’s an unyielding demand for streamlined user experiences, and on the other, an imperative need for iron-clad security. Bridging this gap is the mobile app, a versatile tool that has redefined the very essence of strong authentication.

From serving as a dynamic second layer in two-factor authentication to facilitating real-time transaction approvals, mobile apps are proving to be more than just convenient access points—they’re guardians of digital identity in an interconnected age.

However, like any pioneering frontier, the journey of mobile-based authentication in FinTech is laden with challenges. It demands a meticulous blend of innovation, user education, and proactive threat mitigation. Financial institutions and developers alike must recognize the inherent potential of mobile apps, not just as tools for transactions but as pivotal cogs in the broader security apparatus.

As we navigate the future, one thing is certain: the confluence of FinTech and mobile technology is set to usher in an era where security and convenience don’t just coexist—they synergize. Embracing this synergy is not just an option; it’s a mandate for a future-ready FinTech ecosystem.

Dive deeper into the world of FinTech security and stay abreast of the latest trends with HyperSense. Join us on our journey to craft secure, innovative, and user-centric solutions for the financial sector of tomorrow—contact us if you have any questions.