In today’s digital landscape, having a mobile app is becoming increasingly important for businesses across all industries, including fintech. In fact, according to a recent survey by the Financial Brand, almost 80% of consumers say they prefer to use mobile apps for managing their finances, and more than half of all fintech transactions are now conducted through mobile apps.

But what makes a mobile app so essential for fintech businesses? In this article, we’ll explore the key benefits of building a mobile app for your fintech business, including increased convenience for users, improved user experience, enhanced security, improved trust, better engagement with users, and increased brand visibility. We’ll also provide some key examples and statistics to illustrate these benefits in action.

Mobile App Development for a Competitive Edge

Developing Mobile Apps that Engage Your Customers with Your Brand

Explore Mobile App DevelopmentImproved user experience

Overall, building a mobile app can help your fintech business attract and retain customers, improve the user experience, and stay competitive in an increasingly mobile-driven market.

Mobile apps are often more convenient for fintech users because they can be accessed on the go and provide a quick and easy way for users to manage their financial accounts and transactions. This improves the user experience by making it more convenient and efficient for users to access and manage their financial information, and can also help to reduce the time and effort required to complete financial tasks. Learn more on our blog about The Impact Of User Experience Design on ROI.

Invest in Professional UX/UI Design to Create Impactful Interfaces

Designing Seamless User Journeys That Boost Interaction and Conversion Rates

Discover UI/UX DesignIncreased customer satisfaction

One study found that using mobile apps for financial services can lead to increased customer satisfaction and engagement. The study, which was published in the International Journal of Bank Marketing, surveyed more than 1,000 customers of a major bank and found that those who used the bank’s mobile app reported higher levels of satisfaction and were more likely to recommend the bank to others. The study also found that mobile app users were more likely to use additional financial services offered by the bank, such as investment products and insurance.

Overall, the use of mobile apps for financial services can help to improve the user experience by making it more convenient, efficient, and satisfying for users to manage their financial affairs.

Enhanced security

Mobile apps are considered to enhance security in the fintech field for several reasons. First, mobile apps often provide features such as biometric authentication, that can help to protect user accounts and prevent unauthorized access. Second, mobile apps can provide users with real-time alerts and notifications about suspicious activity on their accounts, which helps users quickly identify and address any potential security threats.

Reduced risks

Recent research has also shown that the use of mobile apps can improve security in the fintech field. For example, a study published in the Journal of Financial Services Marketing found that mobile banking app users were less likely to experience financial fraud compared to those who did not use mobile banking apps. The study surveyed over 1,000 bank customers and found that mobile app users were significantly less likely to fall victim to financial fraud, such as account takeover or unauthorized transactions.

Another study, published in the Journal of Banking and Finance, found that the use of mobile apps can help to reduce the risk of financial fraud by providing users with greater control and visibility over their financial accounts. The study found that mobile app users were more likely to monitor their accounts regularly and were more likely to detect and report suspicious activity, which can help to prevent financial fraud.

One of the latest technological advancements in this area is the use of artificial intelligence (AI) and machine learning. These technologies can be used to analyze user behavior and transactions in real-time, allowing mobile app developers to identify and flag any suspicious activity. This can help to prevent fraudsters from gaining unauthorized access to sensitive financial information.

Another important development in the fight against financial fraud is the implementation of regulations such as PSD2. also known as the Payment Services Directive 2, is a set of regulations that aim to improve the security of online payment transactions. These regulations require financial institutions to implement strong customer authentication measures, such as biometric authentication, to verify the identity of the user. By complying with these regulations, mobile app developers can help to ensure that their apps are secure and protect users from financial fraud.

Another well-known reference that supports the use of mobile apps in reducing the risk of financial fraud is a study conducted by Juniper Research. This study found that the use of AI and machine learning in mobile apps could help to reduce the number of fraud incidents by up to 60% over the next five years. This is a significant reduction in risk and shows the potential of these technologies to help protect users from financial fraud.

Improved trust

Mobile apps can improve trust in fintech companies by providing users with a convenient, user-friendly, and secure way to access and manage their financial accounts and transactions. This can help to build trust by making it easier for users to interact with the fintech companies and by providing them with greater control and visibility over their financial information.

Several key factors can contribute to the ability of mobile apps to improve trust in fintech companies. These include:

- convenience: mobile apps provide users with a quick and easy way to access and manage their financial information on the go, which can make it more convenient for users to interact with fintech companies;

- user-friendliness: mobile apps are often designed to be intuitive and easy to use, which can help to improve the user experience and make it easier for users to trust fintech companies;

- security: mobile apps often provide additional security features, such as biometric authentication, that can help to protect user accounts and prevent unauthorized access. This can help to build trust by providing users with greater confidence in the security of their financial information;

- real-time alerts: mobile apps can provide users with real-time alerts and notifications about suspicious activity on their accounts, which can help users quickly identify and address any potential security threats.

Better engagement

One way that mobile apps can help fintech companies achieve better engagement is by providing users with personalized, relevant, and timely information about products and services. For example, a fintech company could use a mobile app to send users personalized notifications about new investment opportunities that align with their financial goals and risk profile. This can help to improve engagement by providing users with information that is relevant to their individual needs and interests and can also help to increase brand visibility by promoting the fintech company’s products and services.

Another way that mobile apps can help fintech companies achieve better engagement is through gamification. This entails providing users with rewards and incentives for using the app and engaging with the fintech company’s products and services. For example, a fintech company could offer users rewards, such as cashback or discounts, for completing certain actions, such as referring friends or making a certain number of transactions. This can help to improve engagement by providing users with a reason to continue using the app and engaging with the fintech company, and can also help to increase brand visibility by promoting the rewards and incentives offered by the fintech company.

Making Product Discovery Clear and Accessible

Transform Concepts into Products in Four Weeks with Our Proven TechBoost Program

See Product Discovery ServicesIf you want to assimilate deeper knowledge, read our Mobile App Engagement & User Retention blog.

Real-life example

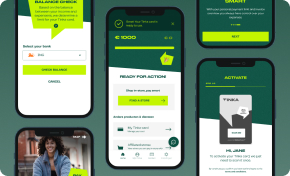

Developing a mobile application for a consumer credit company called Tinka helped them in many ways. First and foremost, the mobile makes it easier for Tinka’s customers to access and manage their accounts on the go. This can be especially useful for their customers as their business targets mainly online shops.

With a mobile app, Tinka’s customers can check their account balances, make online and in-store payments, and view recent transactions from their smartphones. This can save them time and hassle, and make it easier for them to keep track of their finances. The mobile app helps Tinka to improve its customer service. For example, the app includes a built-in chat that allows customers to get in touch with Tinka’s customer service team directly from their smartphones. This makes it easier for customers to get the help they need and improves the overall customer experience and trust in the brand.

With the mobile app, Tinka users better monitor their credit activity. For example, it allows customers to easily view and manage their credit accounts, including checking their credit balances and setting up alerts for upcoming due dates. This helps customers stay on top of their credit obligations and avoid defaulting on their loans. Additionally, the mobile app provides Tinka with real-time data on their customers’ credit activity, allowing them to quickly identify and address any potential issues; if a customer is consistently making late payments or is approaching their credit limit, Tinka uses this information to intervene and offer support to the customer to prevent default, thus reducing the risk of default and improving the overall financial health of their customers.

Another benefit of the mobile app is reaching a wider audience as their business’s main consumer reach tool. Nowadays, many people use their smartphones for various tasks, including payments and managing their finances. By developing a mobile app, Tinka made its services more accessible to a larger number of potential customers, which helped increase brand awareness and drive business growth. Learn how Digital Transformation Through Mobile Apps can help improve your perspective before applying this concept to your own business.

Begin Your Digital Transformation Journey

Customized Strategies to Lead Your Business into the Digital Age

Explore Digital TransformationIf you have a project idea and want to start your digital transformation by building an app for your brand, contact us and let’s push things forward.