Fintech’s Exposure in the Banking Industry

Most industries bring huge opportunities for the largest part of our society, regardless of their small or big sizes, through the presence of technology as the key stimulator of business development. For example, the wave of the ‘dot com’ has served as a turning point by redefining the ways that technology could emerge as a cult, overstepping conventional industry standards. This kind of change is particularly relevant to the banking sector, which underwent a full transformation as soon as the term “Fintech” was coined, employing technology as the conductor to support the majority of financial services in the contemporary day.

Upon entering the modern financial environment, one can see how Fintech companies are battling old systems to completely transform banking services and make them more accessible to everyone with the least amount of collusion. In light of this, the purpose of our blog today is to raise awareness of the emerging technological advancements that will likely make banking future-proof. Let’s go over a few of the technologies that are already having an impact on the banking industry.

Begin Your Digital Transformation Journey

Customized Strategies to Lead Your Business into the Digital Age

Explore Digital TransformationSome Key Technologies Determine Disruption in the Banking Landscape

1. A Look into Quantum Computing’s Future:

Some investment banking businesses, including E&Y and Mckinsey & Company, have been considering quantum computing. They demonstrated a tremendous amount of zeal for using the technology to reduce the risks involved in extending credit. With the help of today’s processors, banks can successfully sift out potential defaulters using sophisticated credit risk ratings.

2. Enjoying the Brilliance of Blockchain Technology:

With the emergence of blockchain technology, a slow banking ecosystem that enabled fraudulent financial transactions, extortion, and a shelter for tax evasion was thrown on its head. In contrast to the sorts of fiat currency presently in use, the advent of blockchain technology meant an alternative decentralized currency paradigm, which proved to be a panacea for bringing banking under the control of law enforcement. In addition, the decentralized ledger system of transaction maintenance would give banking institutions the ability to compile transactional data into a shared resource, so thwarting any attempts at tampering.

3. Transitioning to an Embedded Finance Ecosystem:

It is important to define an embedded finance ecosystem before identifying the technology needed to do this. Thus, the phrase embedded finance has its origins in the field of marketing, where non-financial platforms are used to promote financial goods and services. So, moving to an API-driven product platform would be necessary for banking institutions to participate in such an ecosystem. According to Forbes’ research, two-thirds of financial organizations still don’t use cloud computing in their essential business processes.

4. The Role of AI in Personalized Banking:

Custom Software Development for a Competitive Edge

Build Unique Software Solutions with Our Expertise

Explore Custom SoftwareDays have passed when standing in huge bank lineups was the norm. With the advent of AI-enabled technology, the previously uncharted field of video banking has recently been explored. Integrated remote banking technologies would guarantee an interactive consumer experience. Similarly, AI-driven disruption can be verified through chatbots that demonstrate empathy while offering restitution to dissatisfied customers.

5. Banks Embracing Crypto:

It may sound cynical, but the fact that financial services are betting on the fortunes of crypto is supported by their inherent desire to provide crypto-investment services. Furthermore, payment network behemoths are working to provide crypto-enabled advising services to their retailer and banking clients.

About Us

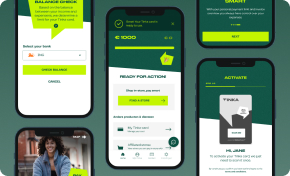

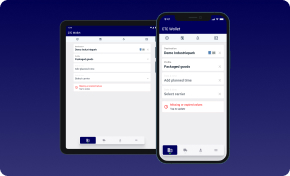

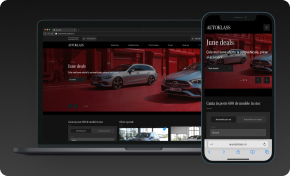

Our team at HyperSense Software constantly aims to deliver technological marvels built like art forms. Our designers & developers keep on expanding their capabilities and transpose their skilled visions every time they create a new software product for emerging markets. Becoming one of the top global software development companies didn’t happen overnight, but rather over the years by continuously improving our services and digital products offered to our clients.

A large range of web & mobile apps was successfully designed, developed, and launched throughout the years and we enjoyed working on every single one of them. Because all our projects reflected who we were at a specific moment in time. We enjoyed evolving and we continue to do so, as we’re more than happy to inspire other businesses to follow the path to evolution through the beauty of technology.

Contact us to find out more about what we do and how we can help you!