Only with a custom mobile app for your FinTech business can you broaden your customer base.

In the current digital world, where everything is so fast, FinTech companies are the ones leading the way in innovation. These companies employ technology to bring forth financial services that are handy, safe, and easy to use. Whether you are a new business or a veteran of the industry, custom mobile app development is a necessity.

Custom Software Perfectly Aligned with Your Strategic Objectives

Software Solutions that Fit and Enhance Your Business Strategy

Explore Custom SoftwareSmart devices are becoming indispensable parts of our lives. Statista reveals that the number of smartphone users worldwide is expected to be about 7.49 billion by the end of 2025. This enormous number shows, in fact, the huge possibility of using mobile apps to reach out to a very large number of people all over the world.

In this article, we will look at why your FinTech business requires a mobile app that is tailored to your needs and how it can help you grow your organization.

Benefits of Mobile Apps in FinTech

The combination of FinTech (financial technology) and mobile apps has totally disrupted how we deal with our finances. These apps provide many advantages, ranging from better user experience and information security to accessibility.

Increased User Retention

Mobile apps are the key to keeping users. They are readily available and seen on users’ home screens, increasing the brand’s reach and memorability. Visualize your FinTech app next to the user’s favorite social media or messaging app. This proximity will ensure that your brand is always in their mind. Also, by creating a user-retention app development strategy, you can ensure a better connection between your users and the app.

For a real-life example, you can dive into the insights shared in Identifying & Preventing Mobile App Deletions and Increasing User Retention article.

Better User Engagement

Apps on mobile devices create a special environment that is both engaging and involving. Users can move around freely, make transactions, and access personalized features. Unlike websites, which may appear distant, apps develop a real and personal connection with users. Options such as instant updates, personalized suggestions, and user-friendly UI attract and make users return.

Effective Communication Channels

Push notifications are an effective tool to communicate with people. Through FinTech apps, brands can push personalized messages to customers’ own devices. Whether it is a promotional offer, an account update, or a security alert, push notifications have higher open and click-through rates than email or any other channel. People like this instant information conveyed straight to their devices.

Enhanced Security

Smartphones are the most personalized gadgets we own. Financial technology apps utilize this intimacy to improve security. Biometric identification (e.g. fingerprints or face recognition) provides a further security layer. On the other hand, apps for mobile devices can use features such as GPS and cameras to work in the KYC process. People are assured that their financial data is safe and they can trust it.

Biometrics for Security and Attributes to Convenience

Biometrics can be an addition to the security measures as well as increase the ease of user interaction. Users can sign in with just a simple touch or glance, thus eliminating the need for complex passwords. Biometric authentication is a means to an end, and thus, it facilitates a smooth flow as well as ensures that transactions are more convenient. Convenience comes in that whether transferring funds or managing investments, users have the freedom to do so without having their security compromised.

The Need for a Customised UX

In the mobile applications’ competitive world, a one-size-fits-all strategy is no longer sufficient.

Invest in Professional UX/UI Design to Create Impactful Interfaces

Designing Seamless User Journeys That Boost Interaction and Conversion Rates

Discover UI/UX DesignMeeting Specific Needs and Preferences

Your application’s success heavily depends on meeting specific requirements and giving your users what they want. Personalization of the UX is about the fact that the users get access to features of high relevance, intuitive navigation, and personalized interactions. Whatever the case may be, from a banking app designed for busy professionals to an investment platform for tech-savvy millennials, understanding your users’ context is of the utmost importance.

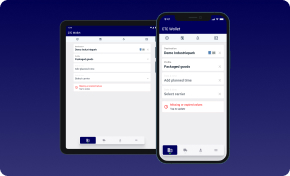

Enhancing Business Flows

An app that is made professionally will never impose a new workflow structure on you but instead fit in with your existing business processes. Customization provides an opportunity to match the app with your business model, thereby making it more seamless. It should be a tool that makes your account management easier, your transactions faster, and your data more up-to-date, not a tool that creates more problems.

Brand Representation and Experience

Your mobile app is, indeed, the champion in the field of your brand. It’s a virtual place where your customers engage in the products or services you offer. The way the app is designed shows your company’s values, reliability, and commitment. In cases where a customized UX is created, it will help with branding consistency and thus increase customer’s trust and loyalty. And when users spot your app’s design elements or colors, and tone, they will be home—the mark of your business.

Top FinTech Mobile Applications to Look Up to

There are already several mobile apps that are outstanding for their innovative features and user-friendly experiences.

Nubank

Nubank is the largest online bank globally, primarily serving customers in Latin America. It offers a range of financial services, including free business and personal accounts, attractive savings rates, and credit card options.

- Free Accounts: Nubank provides free business and personal accounts, making it accessible to a wide range of users.

- Attractive Savings Rates: Users can earn competitive interest rates on their savings, with variable interest paid every single day.

- Credit Cards: Nubank offers credit cards with no annual fees and features like cashback and flexible payment options.

Robinhood

Robinhood is popular for its commission-free stock trading and easy-to-use trading platform. It caters to younger investors and offers features like no fees for trading stocks, cryptocurrencies, and ETFs.

- Commission-Free Trading: Robinhood allows users to trade stocks, cryptocurrencies, and ETFs without paying any commissions.

- 24-Hour Market Access: Users can trade their favorite stocks and ETFs 24 hours a day, five days a week.

- Robinhood Gold: A premium membership that offers features like extended trading hours and margin trading.

Venmo

Venmo is a popular payment app in the US, known for its social integration and secure transactions. It acts as a portable wallet, allowing users to send and receive money easily.

- Social Payments: Venmo makes settling up with friends feel like catching up. Users can split bills, pay for shared activities, and even send fun gift cards.

- Cashback and Shopping: Users can shop at their favorite brands and earn cashback. Digital gift cards are also available for last-minute gifts.

- Venmo Debit Card: Spend your balance anywhere using the Venmo Debit Card, with no monthly fees or minimum balance requirements.

Revolut

Revolut is an all-in-one finance app that offers banking services for retail customers and businesses. It operates globally and provides features like spending, saving, investing, and more.

- Multi-Currency Accounts: Revolut allows users to hold and spend in multiple currencies, making it ideal for international travelers.

- Security: Protected by a dedicated 24/7 team, Revolut ensures security against potentially fraudulent transactions.

- Interest on Savings: Users can earn up to 4.75% AER/Gross (variable) interest on their savings, paid every day.

What Makes a FinTech Mobile App a Good One?

Simplicity and User-Friendliness

An outstanding Fintech app searches for simplicity and user-friendliness. Users ought to be able to do the basic things fast. For example, making a transfer to a friend should be easy: just choose the recipient and enter the amount. Correspondingly, an ACH transfer should take less than a couple of minutes to start. Streamlining processes increases user satisfaction and causes the app to be used more frequently.

Leading Research & Development for Your Success

Driving Innovation in Every Product Aspect Through R&D-Driven Software

Learn About R&D ServicesRobust Security Measures

Security is the number one priority in financial apps. Utilizing device functionalities like biometrics (for instance,fingerprint or facial recognition), location data, and user behavioral patterns offers an additional dimension of security. The users should be reassured that their accounts are not vulnerable to unauthorized access or fraudulent activities.

Mobile-First Design

A FinTech app that is well-designed puts the mobile-first approach as the first priority. Rather than using disordered side menus, why not use tab bars or toggle buttons for simple navigation? Users should have the capability to instantly check on vital information, including the balances of their accounts and credit card details. A clean and easy-to-use interface increases the level of involvement.

Functional Push Notifications

The use of push notifications should be for more than just marketing. Use them to give your users useful information. For example:

- Notify clients when credit card payment fails.

- Let them know about the successful recurrent charges.

- Let users know when they need to make their installment payments.

- Introduce multi-factor authentication through push notifications for more added security.

It is very important to get the right mix of functional and marketing notifications so that users are informed but not overwhelmed.

Real-Time Insights and Analytics

Demonstrate current and past transactions at the top of the app screen. Users like to see their spending patterns, recent transactions, and account balances easily and with one look. Besides, the analytics provided can assist users in budgeting efficiently and managing their finances better.

Integration with Apple Pay and Google Pay

Supporting Apple Pay and Google Pay, which are used by many people, is one of the ways to ensure convenience. Users can easily and conveniently make payment transactions using a method of their choice, thus further simplifying the process of their financial interactions.

Consolidation of Financial Services

Successful FinTech apps usually become “super-apps” by providing a variety of financial services. Beyond basic banking features, consider including:

- Cryptocurrencies and blockchain-related tools.

- Stock trading capabilities.

- Investment options.

- Rewards programs.

- Buy-Now-Pay-Later services.

- Personal loans and cashback options.

Combining these services in one app enables users with a comprehensive financial toolkit at hand.

Accessible Customer Support

Set up a good support system within the app. Use push notifications to keep users updated about the progress of their requests. The client has to wait while an operator helps, and this can be frustrating, so timely notifications make the experience better.

Can Mobile Apps be Integrated with Already Available Financial Backends?

The short answer is “Yes, it can”.

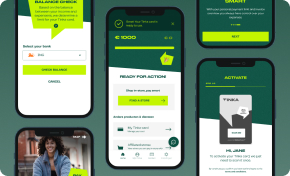

At HyperSense, we were able to connect mobile apps with financial backgrounds for our customers, such as the Dutch consumer credit firm Tinka. The process may seem complicated at first glance, but it is actually an important step that improves user experience and makes financial activities easier.

Experience Matters

Selecting an experienced mobile app development company is the key to success. Thus, creating a user interface (UI) that is customer-oriented is a demanding and complex process. Experienced developers realize the importance of a delicate balance between functionality, security, and usability.

Experience Expert IT Consultancy

Transformative Strategies for Your Technology Needs

Discover IT ConsultingPlanning and Execution

The process of linking a mobile app with a financial backend requires a lot of attention and careful planning. Here are key considerations:

- consider a zero-trust approach

- use microservices and an event-driven approach

- make use of native/technology-based redundancy and fault toleration

- Implement Robust Error Handling and Retry Mechanisms

- closely collaborate with the backend team to ensure full alignment; don’t just rely on the documentation, talk to them;

- challenge every scenario and document edge cases;

- make use of an automated unit, integration, and E2E testing;

- create decoupled mechanisms for both-way integration, E.g.: build an agnostic push notification microservice that exposes a queue where financial systems can post messages triggering push notifications.

FinTech Custom Mobile App

The customized FinTech apps cross over the gap between traditional banking and next-gen technology. They facilitate users to handle finances, invest, and transact smoothly. These apps address the needs of the user by providing a safe and secure environment and real-time information, and thus, become an indispensable tool for financial wellbeing.

With every evolving trend, custom mobile solutions might be the very tool to stay up-to-date and lead innovation in the continuously evolving world of the financial market. Let’s meet and discuss how we can support you in your endeavors.