Trust and security are paramount pillars in the ever-evolving landscape of the financial services industry. With the relentless drive towards a digital-first world, the importance of cybersecurity in this domain has never been more pronounced. A report by Deloitte US shines a light on this very imperative, emphasizing the critical balance required in our age of rapid digital transformation.

The COVID-19 pandemic, an unprecedented global event, has brought with it waves of change across industries. For the financial sector, this meant an expedited transition to remote work and a hastened pace of digitalization. Such swift changes were not merely a result of necessity but presented a silver lining, paving the way for a more inclusive and efficient financial system that can promote economic development in broader spectra. Innovations in FinTech promise easier access, more personalized experiences, and novel opportunities for businesses and individuals alike.

Yet, with every digital stride we take, the shadows of risk loom larger. The same Deloitte report underscores the flip side of this coin: an increased susceptibility to cyberattacks. As businesses moved their operations online, cybercriminals saw fresh opportunities, leading to a surge in cyber threats targeting the financial sector. Recognizing the gravity of these risks, many organizations have decisively stepped up their cybersecurity defense efforts. But as we move further into this digital era, the question remains – how can FinTech platforms bolster their defenses to ensure trust, confidence, and unwavering security?

In this article, we dive deep into the world of strong authentication in FinTech, unearthing its significance, methods, challenges, and the path ahead.

IT Consultancy for Strategic Advantage

Tailored IT Solutions to Drive Your Business Forward

Discover IT ConsultingThe Evolution of Authentication in FinTech

The journey of authentication in the financial sector is a compelling tale of technology trying to keep pace with ever-evolving security threats.

From Simple Passwords to 2FA

In the early days of digital banking and financial services, simple usernames and passwords were the primary barriers between users and their data. This rudimentary system soon revealed its vulnerabilities as online threats began to mount. Unauthorized access, phishing scams, and brute force attacks highlighted the need for enhanced security measures.

Enter two-factor authentication (2FA). This method added an additional layer of security by requiring users to provide two separate forms of identification before gaining access. Typically, this would be something they know (like a password) and something they have (like a one-time code sent to their phone). 2FA dramatically reduced the chances of unauthorized access, even if the primary password was compromised.

Today’s Strong Authentication Paradigm

Today’s cyber world is far more intricate, with sophisticated threats that demand equally sophisticated defenses. The current authentication methods in FinTech go beyond the simple password and 2FA systems. Now, we see the incorporation of biometrics, smart tokens, adaptive authentication, and other cutting-edge technologies. These measures enhance security and are designed to streamline the user experience, marrying convenience with security.

The Value of Multi-Factor Authentication (MFA)

Building on the foundation of 2FA, MFA introduces multiple layers of verification. This could involve combining a password, a biometric scan (like a fingerprint or facial recognition), and a smart card. The beauty of MFA lies in its flexibility. FinTech platforms can adjust the number and types of authentication factors based on the level of security required, offering a tailored approach to data protection.

Accelerate Your Growth with Digital Transformation

Digital Excellence Through Customized Business Solutions

Explore Digital TransformationWhy is Strong Authentication Crucial in FinTech?

In today’s interconnected digital ecosystem, the financial sector sits as a prime target for cybercriminals. But why is robust authentication in FinTech not just an added perk, but an absolute necessity?

Growing Cyber Threats and Financial Fraud

Every day, cyberattacks grow more sophisticated. From spear-phishing campaigns to advanced persistent threats, the strategies cybercriminals deploy are evolving. FinTech platforms, being repositories of sensitive financial data, are particularly enticing targets. Strong authentication acts as the first line of defense, ensuring that only authorized users gain access.

Ensuring User Trust and Confidence

Trust is the backbone of the financial industry. Users need to know their personal and financial data are in safe hands. Every security breach or data leak can significantly erode that trust. By implementing stringent authentication measures, FinTech platforms send a clear message to users: “Your security is our priority.”

Regulatory Pressures and Requirements

It’s not just about user trust and cyber threats. Regulatory bodies worldwide have recognized the importance of cybersecurity in the financial sector. Many have set forth mandates requiring enhanced authentication practices for financial platforms. Staying compliant is not just about avoiding penalties but about upholding industry standards and best practices.

The Domino Effect of a Single Breach

One might think, “It’s just one account,” but in the interconnected world of FinTech, a single breach can have cascading effects. Unauthorized access can lead to financial fraud, identity theft, and even larger-scale breaches if internal systems are compromised. This not only impacts the affected user but can jeopardize the integrity of the entire platform.

Understanding Strong Authentication Methods

The complexity of the cyber threats today demands multifaceted authentication measures. So, what are these methods, and how do they serve the FinTech sector? Let’s break them down.

Definition and Explanation

Strong authentication, often synonymous with multi-factor authentication (MFA), refers to the practice of verifying a user’s identity through multiple distinct factors. These are typically divided into three primary categories:

- Something you know: This is the traditional form of authentication, encompassing passwords, PINs, and answers to secret questions.

- Something you have: Physical or digital objects that prove your identity fall into this category. Examples include smart cards, security tokens, or a mobile device that receives a one-time passcode (OTP).

- Something you are: Biometrics are quickly becoming a standard in the world of FinTech due to their uniqueness and difficulty to replicate. This includes fingerprints, facial recognition, iris scans, and voice patterns.

The Power of Combining Factors

The true strength of MFA lies in its combination. A cybercriminal might crack a password, but it’s exponentially harder for them to simultaneously have access to a user’s physical device or replicate their fingerprint. By requiring multiple forms of verification, the probability of unauthorized access drops dramatically.

Adaptive Authentication

This is a newer trend where the authentication process is dynamic and based on various risk factors. For example, if a user typically logs in from a specific city but suddenly attempts to log in from another country, the system might require additional verification steps. This method adds an extra layer of security while ensuring a smoother experience for genuine users.

Implementing Strong Authentication in FinTech Platforms

As FinTech platforms evolve, integrating advanced authentication becomes less of an option and more of a requirement. But how do businesses seamlessly incorporate these measures? Let’s explore.

The Integration Process

- Needs Assessment: Before diving into the solutions, platforms must identify their specific needs. This involves evaluating user demographics, the types of services offered, and potential vulnerabilities.

- Choosing the Right Methods: Based on the needs assessment, platforms can decide which authentication methods best align with their operations. For instance, a global platform with a diverse user base might prioritize biometric verification due to its universal applicability.

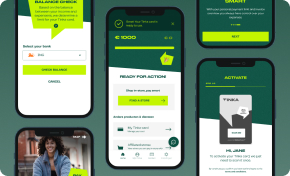

- Partnering with Technology Providers: Implementing sophisticated authentication often requires collaboration with specialized tech providers or consultancies like HyperSense, which possess the expertise and tools to streamline integration.

- Testing & Iteration: Before a full-fledged launch, pilot testing with a subset of users can offer invaluable insights. Feedback can guide refinements, ensuring that the final roll-out is both secure and user-friendly.

Leading Development Teams for Your Success

Optimize Your Project Execution with Our Dedicated Development Teams

Get Your Development TeamFactors to Consider

- User Experience (UX): While security is paramount, platforms shouldn’t overlook the user journey. Excessive authentication steps can deter users. The goal is to achieve security without adding undue friction.

- Technological Capabilities: Integration should match the platform’s existing tech infrastructure. It’s essential to ensure that the chosen methods are compatible and scalable.

- Regulatory Compliance: With global FinTech platforms, it’s crucial to keep abreast of authentication-related regulations across different regions and ensure full compliance.

Continuous Updates & Education

Security isn’t a one-time affair. As threats evolve, so should authentication methods. Regular updates, combined with educating users about the importance and mechanisms of these security measures, can go a long way.

Implementing strong authentication in FinTech is a nuanced process, blending technology, user-centric design, and regulatory acumen. With the right approach and guidance, platforms can safeguard their operations while offering a seamless experience to users.

Challenges and Solutions in Adopting Strong Authentication

As promising as robust authentication sounds, its adoption is not without hurdles. FinTech platforms must be aware of potential challenges and craft strategies to mitigate them.

Challenges:

- Resistance to Change: Traditional banking and financial customers, especially those less tech-savvy, might resist new authentication methods, perceiving them as complex or invasive.

- Cost Implications: Advanced authentication mechanisms, especially biometric systems, can come with significant upfront costs for acquisition and integration.

- False Rejections: Stringent authentication methods can sometimes lock out genuine users, mistaking them for potential threats.

- Data Privacy Concerns: Biometrics, in particular, raise concerns about data storage, management, and potential misuse.

Solutions:

- User Education: To overcome resistance, platforms can run educational campaigns, offering easy-to-understand guides, tutorials, and webinars, elucidating the importance and operation of new authentication methods.

- Cost-Benefit Analysis: While there might be immediate costs, platforms should weigh these against the potential long-term losses from cyberattacks and breaches. Often, the investment in robust authentication offers substantial ROI in terms of security and trust-building.

- Tuning and Feedback Loops: To reduce false rejections, systems should constantly be refined. Employing adaptive authentication and allowing users to provide feedback on their experiences can lead to continuous improvement.

- Transparent Data Policies: Addressing data privacy concerns necessitates transparency. Platforms should provide clear guidelines on how biometric or personal data is stored, encrypted, used, and deleted. Assurances of compliance with global data protection standards can also alleviate user concerns.

Experience Our Research & Development Expertise

R&D-Led Software Development Integrates Innovation into Every Product Detail

Learn About R&D ServicesAdopting strong authentication in FinTech is not just about technology but also understanding and addressing user concerns and challenges. With the right strategies, platforms can make this transition smoother for themselves and their user base.

The Future of Authentication in FinTech

As we navigate deeper into the digital age, the symbiotic relationship between technology and financial services will only grow stronger. We’re on the brink of a new era where the lines between physical and digital identities blur. In this landscape, the demand for advanced authentication tools that are not only secure but also user-friendly will amplify.

While the path to integrating strong authentication presents its set of challenges, the potential rewards—in terms of security, user trust, and compliance—are monumental. Financial platforms that proactively embrace these advancements will not only safeguard their operations but also position themselves as leaders in an ever-evolving FinTech landscape.

Ready to fortify your FinTech platform with cutting-edge authentication methods? The experts at HyperSense can guide you through every step, ensuring a seamless, secure, and user-centric experience. Reach out to us today and take the leap into the future of financial security!