The financial world is evolving rapidly, with technology playing a pivotal role in shaping how investments are made and managed. Investment platforms have emerged as a cornerstone in this dynamic environment, democratizing access to a range of financial instruments and opportunities. Whether it’s for trading stocks, crowdfunding, or exploring new avenues in fintech, the development of a robust, user-centric investment platform can be a game-changer in this thriving market.

Amidst this backdrop, understanding how to develop a successful investment platform is crucial. Our journey through this guide will cover the essentials – from initial conception to the final launch and beyond, focusing on technical, regulatory, and market considerations. This is not just about building software; it’s about creating a gateway that empowers and engages modern investors.

Redefine Your Business with Custom Software Development

Tailored Software Solutions Designed for Your Growth

Explore Custom SoftwareUnderstanding the Basics of Investment Platforms

What is an Investment Platform?

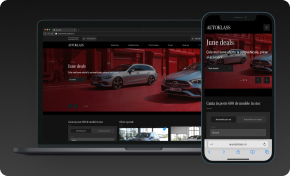

At its core, an investment platform is an online solution that facilitates the buying, selling, and managing of financial assets. These platforms range from stock trading apps to complex equity crowdfunding portals. Their key purpose is to simplify and streamline the investment process for all users, regardless of their experience level or capital size.

Types of Investment Platforms

- Trading Platforms: Allow users to buy and sell stocks, bonds, and other securities.

- Crowdfunding Platforms: Enable startups and businesses to raise capital from a wide range of investors. Equity crowdfunding platforms, like truCrowd, are notable examples.

- Robo-Advisors: Automated platforms providing algorithm-driven financial planning services with minimal human supervision.

- Peer-to-Peer (P2P) Lending: Facilitates borrowing and lending among individuals without the involvement of traditional financial institutions.

Role in the Financial Ecosystem

Investment platforms have revolutionized the finance world by:

- Enhancing Accessibility: Lowering the barriers for entry into the investment world.

- Providing Diversification: Offering a wide array of investment options.

- Ensuring Transparency: Delivering clear information on investment opportunities and risks.

In this digital era, an effective investment platform isn’t just a tool; it’s a vehicle driving financial inclusion and literacy, paving the way for more informed, strategic investment decisions.

Key Features of a Successful Investment Platform

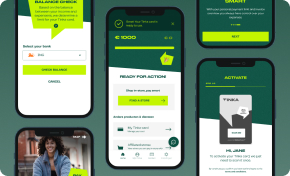

1. User-Friendly Interface

- Simplicity: Easy navigation and clear instructions guide users seamlessly.

- Intuitive Design: Quick access to important features like portfolio overview, transaction history, and market trends.

- Mobile Responsiveness: With the increasing use of smartphones, having a mobile-friendly platform is crucial.

Enhance User Experience with Our UX/UI Design Services

Crafting User-Centered Designs That Enhance Engagement and Maximize Conversions

Discover UI/UX Design2. Secure and Robust Technology

- Data Encryption: Safeguarding user data with advanced encryption techniques.

- Regular Audits: Continuous testing and updates to ensure the highest security standards.

- Backup and Recovery: Systems in place for data backup and quick recovery in case of a breach or failure.

3. Comprehensive Asset Coverage

- Diverse Investments: Offer a range of assets – stocks, bonds, ETFs, cryptocurrencies, etc.

- Real-Time Updates: Live feeds of market data and news to aid in informed decision-making.

4. Regulatory Compliance

- Adherence to Laws: Comply with local and international financial regulations.

- Transparent Operations: Clear and straightforward disclosure of fees, risks, and user agreements.

5. Customer Support and Education

- Responsive Support: Quick and helpful customer service for user inquiries and issues.

- Educational Resources: Guides, tutorials, and webinars for all levels of investors.

6. Scalability

- Handling Growth: Ability to accommodate an increasing number of users and transactions without performance lags.

- Future Expansion: Easy integration of new features and services.

7. Social Features and Community Building

- Networking Opportunities: Forums or chat features for investors to share insights and strategies.

- Collaboration Tools: Enable users to follow expert investors or participate in group investments.

Reflecting on HyperSense’s experience with truCrowd, these features are not just theoretical. They’re tested components, essential in creating a platform that resonates with users and withstands market shifts. A platform mastering these elements can significantly enhance user trust and engagement, key drivers for long-term success.

Planning Your Investment Platform

Market Analysis and Target Audience

- Identify Your Niche: Understand who your platform is for – beginners, seasoned investors, or a specific sector like startups.

- Market Needs: Research current trends, gaps in services, and what competitors are offering.

- User Personas: Create detailed profiles of potential users to tailor features and marketing strategies.

Regulatory Compliance and Legal Considerations

- Understanding Regulations: Stay updated with financial regulations like the SEC rules in the U.S., especially for equity crowdfunding platforms.

- Legal Framework: Consult legal experts to navigate the complexities of financial laws, protecting both your platform and its users.

- License Requirements: Ensure you have the necessary permissions and licenses to operate legally.

Accelerate Your Growth with IT Consultancy

Propel Your Business with Expert Tech Insights

Discover IT ConsultingDeveloping a Unique Value Proposition (UVP)

- Differentiation: Determine what sets your platform apart – it could be unique features, exceptional user experience, or specialized investment opportunities.

- Solving User Problems: Your UVP should focus on addressing specific issues or needs of your target audience.

Designing for Your Audience

- User Experience (UX): The platform should be intuitive, aesthetically pleasing, and accessible to users with varying levels of investment knowledge.

- Feedback Loops: Engage with potential users early on through surveys, prototypes, and beta testing to gather feedback and iterate.

Financial and Operational Planning

- Budgeting: Outline costs including development, licensing, marketing, and ongoing operations.

- Resource Allocation: Plan your team structure – from developers to financial analysts, and customer service staff.

- Risk Assessment: Identify potential risks in the development and launch phases and plan for contingencies.

A careful balance between innovation, user-centric design, and stringent adherence to legal norms is key. This planning phase is critical; it lays the foundation upon which the entire platform will be built and grown.

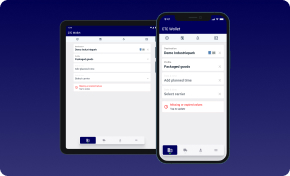

Technical Aspects of Platform Development

Choosing the Right Technology Stack

- Frontend and Backend: Select technologies that ensure reliability, speed, and flexibility. Popular choices include Flutter, React or Angular for the frontend, and Node.js, Scala or .NET for the backend.

- Database Management: Use robust database systems like PostgreSQL or MongoDB to handle large volumes of data securely.

- API Integration: Ensure smooth integration with third-party services for payments, data feeds, and more.

Experience the Power of Professional Web Development

Transformative Web Solutions Designed for Your Business Growth

Discover Web DevelopmentScalability and Security Features

- Handling Traffic Spikes: Architect your system to manage sudden increases in user numbers and transaction volumes.

- Data Protection: Implement stringent security measures such as SSL encryption, two-factor authentication, and regular security audits.

- Compliance Standards: Adhere to relevant data protection regulations like GDPR or HIPAA, depending on your location and audience.

Cloud Infrastructure and Hosting

- Cloud Services: Leverage cloud platforms like AWS or Azure for scalable, reliable infrastructure.

- Continuous Deployment: Set up systems for continuous integration and deployment to streamline updates and fixes.

Traceability and Extended Logs

- Audit Trails: Maintain comprehensive logs and audit trails to track user actions and system changes, enhancing security and accountability.

- Troubleshooting: Use detailed logs to quickly identify and resolve issues, improving overall system reliability and performance.

User Data Analytics and Reporting

- Data Analytics: Implement tools to track user behavior, investment patterns, and more to help refine and improve the platform.

- Reporting Tools: Provide users with detailed reports and insights on their investments and market trends.

Quality Assurance and Testing

- Rigorous Testing: Conduct thorough testing phases including unit testing, integration testing, and user acceptance testing (UAT) to ensure a bug-free and smooth user experience.

- Performance Optimization: Regularly monitor and optimize the performance of the platform to handle large user numbers and data volume efficiently.

Focusing on a robust, scalable architecture is essential for any investment platform. This strong technical foundation ensures the platform not only meets current user expectations but is also primed for future growth and challenges.

Launching and Marketing Your Platform

Pre-Launch Strategies

- Beta Testing: Invite a select group of users to test the platform. Gather feedback and make necessary adjustments.

- Building Anticipation: Use social media, email campaigns, and industry partnerships to create buzz around your platform.

Launch Tactics

- Soft Launch: Start with a limited audience to iron out any last-minute issues.

- Full Launch: Roll out the platform to the wider public with all features operational.

- Launch Event: Consider hosting a webinar or online event to showcase your platform’s capabilities and value proposition.

Marketing Strategies

- Content Marketing: Publish articles, blogs, and white papers to demonstrate thought leadership and attract organic traffic.

- SEO: Optimize your website for search engines to increase visibility.

- Social Media: Engage with your audience on platforms like LinkedIn, Twitter, and Facebook to build community and brand awareness.

User Engagement and Retention

- Email Campaigns: Keep users engaged with regular updates, tips, and exclusive offers.

- Feedback Loops: Implement mechanisms for users to provide feedback and suggestions, showing that you value their input and continuously improve the platform.

- Incentives: Offer referral bonuses or loyalty programs to encourage users to invite others.

Partnerships and Collaborations

- Industry Partners: Partner with financial advisors, investment bloggers, or other fintech platforms to reach a broader audience.

- Integration Partners: Collaborate with related services like payment gateways or financial data providers to enhance your platform’s offerings.

Post-Launch Analysis and Iteration

- User Analytics: Monitor how users interact with your platform. Use this data to refine and improve features.

- Performance Metrics: Track metrics like user acquisition rates, engagement levels, and churn rates to measure success and identify areas for improvement.

Continuous Improvement

- Regular Updates: Keep the platform fresh with new features and enhancements based on user feedback and market trends.

- Stay Informed: Keep an eye on financial market trends and technological advancements to ensure your platform remains relevant and competitive.

Launching and marketing an investment platform requires a well-coordinated effort, combining technical readiness, market insight, and continuous engagement with your audience. A successful launch sets the tone for future growth and user loyalty, making it a critical phase in your platform’s journey.

Monitoring and Evolving Your Investment Platform

Staying Agile

- Adaptability: The finance and technology sectors are fast-evolving. Stay ready to adapt to new regulations, market conditions, and technological advancements.

- User Feedback: Continuously collect and analyze user feedback to guide your platform’s evolution.

Leveraging Analytics for Growth

- User Behavior: Dive deep into user interaction data to understand and predict trends, improve features, and tailor user experiences.

- Performance Metrics: Regularly review key performance indicators (KPIs) such as acquisition rates, active users, and transaction volumes to gauge success and identify growth opportunities.

Ensuring Continuous Security and Compliance

- Regular Updates: Keep security protocols and software up to date against evolving cyber threats.

- Compliance Checks: Regularly review and update your platform to ensure it complies with changing financial regulations.

Fostering a Culture of Innovation

- New Features: Regularly introduce new features and enhancements based on technological advancements and user demand.

- Employee Input: Encourage ideas and suggestions from your team. Often, those working on the platform daily can provide invaluable insights.

Community Building and Customer Loyalty

- Engagement: Maintain strong relationships with your user base through active engagement, excellent customer support, and community-building activities.

- Rewards and Recognition: Implement programs to reward loyal users and acknowledge their contributions to the platform’s community.

Long-Term Vision

- Scalability: Continuously assess the platform’s infrastructure and capabilities to ensure it can grow with your user base and transaction volume.

- Market Positioning: Keep an eye on your competition and market trends to strategically position your platform for long-term success and differentiation.

Your Path to Innovation Starts with Digital Transformation

Customized Digital Strategies for Competitive Advantage

Explore Digital TransformationBuilding and evolving an investment platform is an ongoing journey, demanding a balance between innovation, user-centric development, and operational excellence. By staying vigilant, responsive, and forward-thinking, you can ensure that your platform not only meets the current demands of the investment community but also shapes its future.

HyperSense’s comprehensive guide to developing an investment platform concludes with this essential reminder: the journey doesn’t end at launch. Success lies in constant monitoring, adaptation, and evolution, staying true to your vision while meeting the ever-changing needs of the market and your users.

Interested in Developing Your Investment Platform? Let’s Talk!